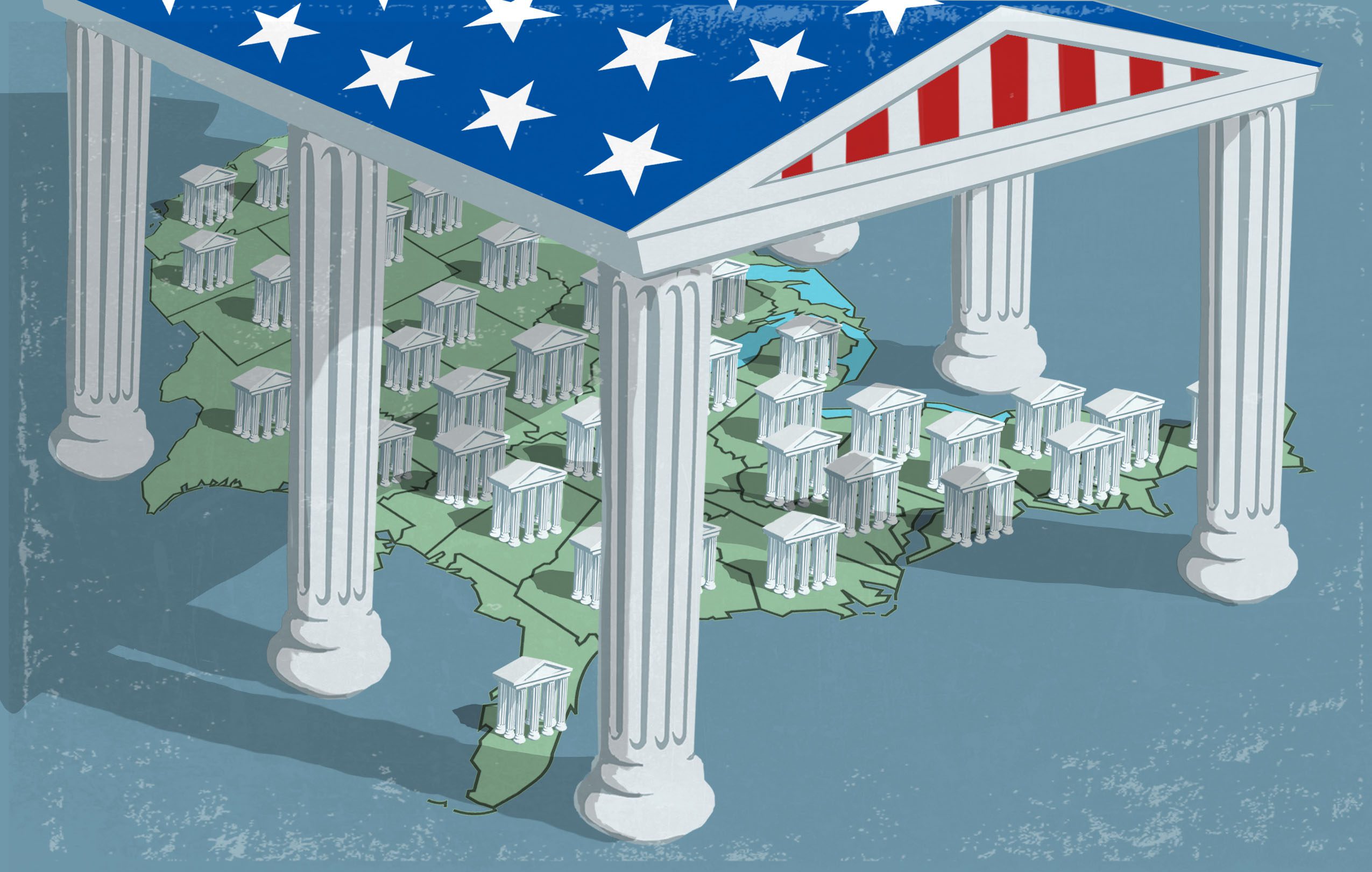

Once a business has survived the initial fight for survival, then begins the chapter to strategically grow with projects that offer improved margins. A proven avenue for growth is the acquisition and servicing of government contracts.

Of course, lucrative projects don’t just lie down in our laps, and government contracts are no different. State, Local, and National Government Contracts operate with a bidding process during which the business will need to show proof of bonding and insurance.

Fortunately for the eager to grow businesses, our agency has a niche in providing coverage when requirements get tough. Wes Connor insurance is an experienced agency helping clients expand their coverage base to reach projects that propel growth.

Government Contracts: Insurance Standards

Contracts with local and state government entities typically require $5 Million in liability coverage for any one occurrence. This will require the insured company to have an Umbrella or Excess Liability policy to place on top of the existing general liability.

The $5 MM mark can be achieved with either a $3MM or $4MM Umbrella, depending on the structure of the underlying policy. Wes Connor Insurance while remaining independent has the resources to combine coverage from across the market to provide the most cost-effective solutions.

Government Contracts: Legal Wording and Certificates

Government entities are stringent on legal wording and certificate compliance. For businesses that rely on bidding for jobs, experience and care with the certificates is critical to ensure that the bid process runs smoothly.

Our agency has qualified experience working directly with divisions of state government to assist our clients through regulations relating to insurance. We take the weight by determining what is needed, and driving the process for the client.

In times when accuracy is paramount, and timing is critical, our agency will reach out to the intended division of government and parlay the information to ensure that all parties are informed with the needed information.

Government Insurance Requirements: Other Benefits

Covering your base with the insurance requirements of government entities places your business in a premier position to bid on any size job. The coverage standards promulgated by the authority of government are also the standard for large scale projects involving national entities.

Due to the scale of exposure, a national operating entity may require $5 million limits and equally stringent wording to strategically decentralize their potential losses.

If you are considering gearing up for growth, and want to understand how to plan and prep your insurance for success, our agency is a prime location to begin the conversation.